LOCKHEED MARTIN (LMT)·Q4 2025 Earnings Summary

Lockheed Martin Beats on Revenue, Guides Above Street as Backlog Hits Record $194B

January 29, 2026 · by Fintool AI Agent

Lockheed Martin delivered Q4 2025 revenue of $20.3 billion, beating consensus by 2.3% on strong demand across all four segments, though EPS of $5.80 missed estimates due to a $479 million pension settlement charge . The defense giant guided 2026 revenue and EPS above Street expectations while announcing a record $194 billion backlog — driving shares up 5.5% in after-hours trading to $630.33.

CEO Jim Taiclet opened the call highlighting "unprecedented demand for Lockheed Martin's industry-leading defense technologies" and record deliveries: 191 F-35s and 620 PAC-3 MSE interceptors in 2025 — both all-time highs . Lockheed also announced a THAAD interceptor framework agreement this morning, following the PAC-3 deal announced earlier in January .

Did Lockheed Martin Beat Earnings?

Revenue beat, EPS missed on a pension charge — but the underlying business is strong.

*Values retrieved from S&P Global

The EPS miss requires context: Q4 2025 included a non-operational pension settlement charge of $479 million ($377 million, or $1.63 per share, after-tax) related to transferring $943 million of pension obligations to insurance companies . Adjusting for this charge, EPS would have been approximately $7.43 — a significant beat.

The year-over-year EPS improvement of 161% reflects the absence of the $1.7 billion classified program losses that crushed Q4 2024 results .

How Did the Stock React?

Shares surged 5.5% after-hours as investors embraced the strong guidance and record backlog.

The after-hours rally pushed LMT to an all-time high, breaking through the previous 52-week high of $599.32 set earlier in the regular session. The stock has gained nearly 45% from its 52-week low of $410.11.

What Did Management Guide?

2026 guidance exceeded consensus on both revenue and EPS — and management sounds confident.

*Values retrieved from S&P Global

The guidance implies approximately 5% revenue growth and 25% segment operating profit growth year-over-year . Management specifically cited the Department of War's Acquisition Transformation Strategy and the "landmark, seven-year framework agreement for PAC-3 missiles" as drivers of confidence .

Note on quarterly cadence: 2026 has 12 weeks in Q1 and 14 weeks in Q4 (vs. 13 weeks each in 2024-2025), which will affect quarterly comparisons .

2026 Segment-Level Guidance

MFC margin outlook: CFO Evan Scott noted MFC margins could see 20-30 basis points of dilution in the near term due to the startup nature of the PAC-3/THAAD ramps, but "that's gonna then create, over time, an opportunity to exceed MFC margins beyond where they have historically been" . CEO Taiclet added: "That margin pressure... will be in an environment where sales should be double-digit growth in MFC and maybe even mid-teens sales growth. We'll take that trade."

What Changed From Last Quarter?

Margin recovery accelerated as program losses stayed contained and volume ramped.

The sequential improvement reflects:

- No new program losses — After taking $1.6 billion in charges in Q2 2025 (classified Aeronautics program, CMHP, TUHP), Q4 was clean

- Volume ramp — F-35 production and PAC-3/missile programs drove double-digit revenue growth

- Favorable profit adjustments — Q4 2025 had $275 million in net favorable profit booking rate adjustments

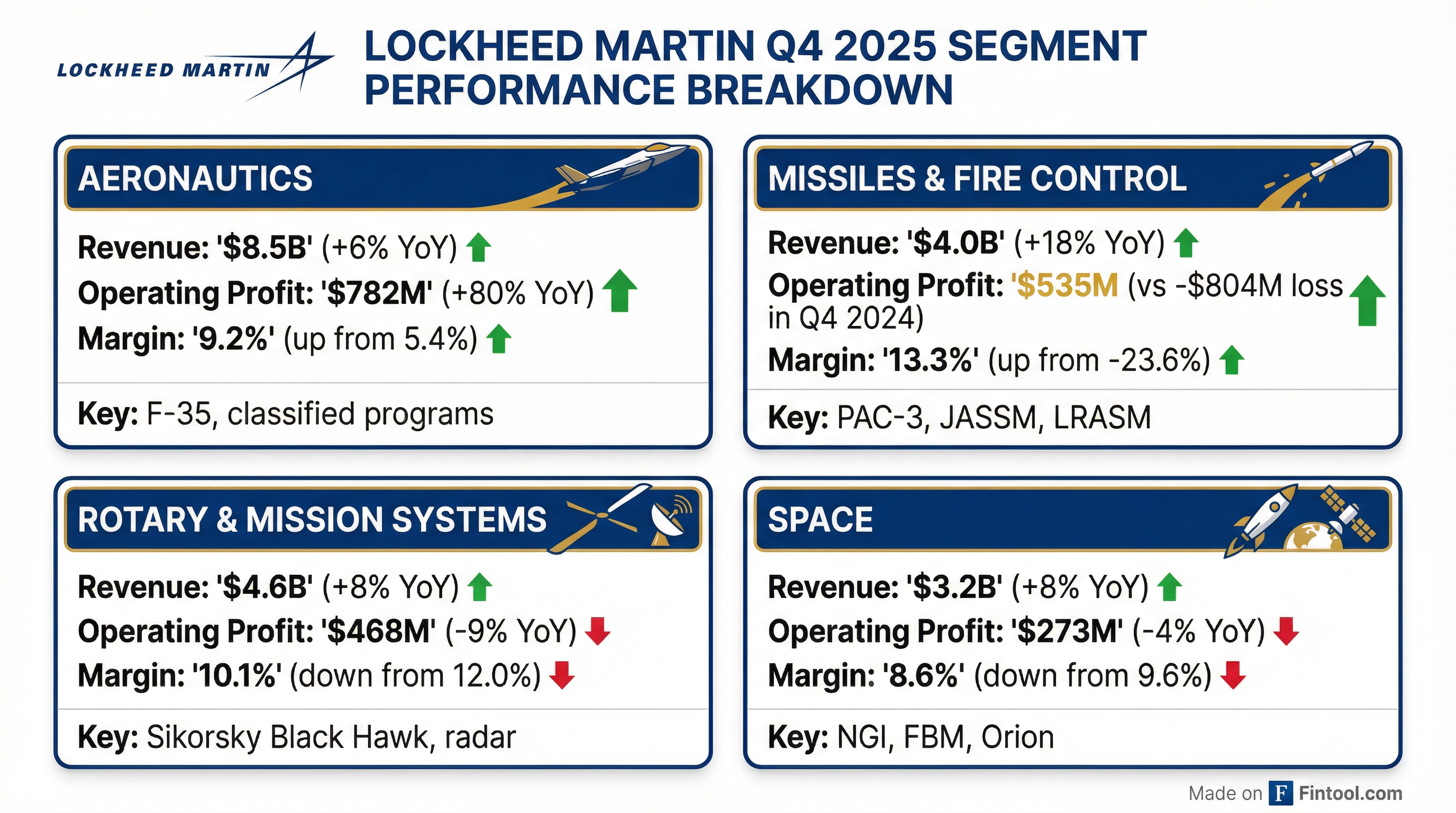

Segment Performance

Aeronautics — The F-35 Engine Keeps Running

Aeronautics delivered 48 F-35s in Q4 (vs. 62 in Q4 2024), bringing the full-year total to 191 aircraft . The margin improvement reflects the absence of Q4 2024's $410 million classified program loss and higher F-35 production volume .

Missiles & Fire Control — The Star Performer

MFC swung from a $804 million operating loss (due to $1.3 billion in classified program losses in Q4 2024) to a $535 million profit . The production ramp-up of PAC-3, JASSM, and LRASM missiles drove $608 million in incremental sales .

Rotary & Mission Systems — Margin Pressure Persists

RMS grew revenue on Sikorsky Black Hawk production and radar programs but saw margins compress due to unfavorable profit adjustments on Black Hawk programs . The segment is still working through the Q2 2025 losses on CMHP ($570M) and TUHP ($95M) helicopter programs .

Space — Steady Eddie

Space benefited from higher volume on Next Generation Interceptor (NGI), Fleet Ballistic Missile (FBM), and Orion programs, offset by lower equity earnings from United Launch Alliance (ULA) .

Capital Allocation

Record backlog, strong FCF, and continued shareholder returns.

The record $194 billion backlog represents approximately 2.6 years of revenue at current run rates. Backlog growth was led by:

- Missiles & Fire Control: +$7.9B to $46.7B

- Rotary & Mission Systems: +$9.6B to $47.7B

- Space: +$3.4B to $39.8B

Management invested over $3.5 billion in production capacity and next-generation technologies during 2025 .

Key Risks and Items to Watch

Program Losses — The Overhang Remains

FY 2025 included $1.6 billion in program losses :

- $950 million on a classified Aeronautics program (Q2 2025)

- $570 million on CMHP and $95 million on TUHP helicopter programs (Q2 2025)

- $140 million in unfavorable profit adjustments on C-130 program

While Q4 2025 was clean, investors should monitor whether additional charges emerge on these programs.

Pension Dynamics

The Q4 2025 pension settlement charge ($479 million) reduced reported EPS by $1.63 . The 2026 outlook assumes a total FAS/CAS pension adjustment of approximately $1.37 billion .

Government Policy Risk

Management noted the 2026 outlook "does not include potential impacts of government shutdown, or Executive Orders issued by the Administration" . Defense spending remains subject to political dynamics.

What Management Avoided

Despite a detailed Q&A, management deferred on:

- Specific share repurchase/dividend plans for 2026 — Taiclet said they'll "disclose when we can" as decisions are made

- Multi-year financial framework — "We're not ready to give multi-year frameworks at this point"

- Precise F-35 Block 4 timeline — Committed to "making further progress" in 2026 without specifics

Q&A Highlights

Capital Allocation Strategy Shift

When asked if Lockheed would continue returning 100% of free cash flow to shareholders, CEO Taiclet signaled a potential shift: "The opportunity set is much greater... the conditions have changed on the availability of accretive investments that we can make in our company" . He cited three drivers:

- Long-term contracts: The 7-year framework agreements create "stable growth opportunities... ROIs will exceed our cost of capital"

- R&D expansion: "The department's very transparent interest in advanced technology development" opens more prototype opportunities

- M&A optionality: "We have been active in exploring and even attempting some mergers and acquisitions during the last five years. One that was publicized wasn't approved by a different administration. So we're going to keep our powder dry."

PAC-3/THAAD Framework Structure

Key details emerged on the landmark multi-year agreements:

- Make-whole provisions: "If there is a change in the procurement strategy along the way during the seven years, there are make-whole provisions that will bring our company back to... the same ROI cash flow perspective as we would normally have had in a single year appropriation"

- Profit-sharing mechanism: Above a "robust level" of performance, Lockheed shares increased profits with the government by reinvesting in spare parts, equipment, or tooling

- Cash flow support: "You are going to see an elevated working capital benefit or operational benefit to offset some of these CapEx expenditures"

- Expected timeline: Both programs expected "up and running... by this year, 2026" pending appropriations

F-35 Sustainment Investment

Taiclet committed an additional $1 billion+ investment to F-35 spare parts and repairs, citing "underfunding... in the various defense budgets previous to this administration" . The goal is to "improve the mission capable rates of the aircraft" — described as "an absolute priority for us" .

Disruptive Technology & Innovation

When asked about technology disruption from newer entrants, Taiclet gave an extensive defense of Lockheed's innovation capabilities:

"We are all about disruptive technology. Some we'll do on our own, some we'll do with our aerospace and defense prime partners, some we'll do with smaller and more novel companies."

Key R&D initiatives mentioned:

Aero Classified Program Status

On the problem program that drove $950M in Q2 2025 charges: "There were no additional charges reported on this program in the fourth quarter... being monitored monthly, as never before" with "highest level of executives personally involved" .

2027 Pension Requirements

CFO Scott noted required pension contributions return in 2027: "At least $1 billion, depending on how we look in terms of pension performance this year" . If 2026 cash flow is strong, there "may be an opportunity to pre-fund 2027's required pension as well."

Forward Catalysts

Lockheed Martin reports earnings on January 29, 2026. Access the full Q4 2025 earnings call transcript and 8-K filing on Fintool.